Meet the new bank crisis. NOT the same as the old bank crisis. This is not the Great Financial Crisis II. It’s not the collapse of Long-Term Capital Management in 1998. It’s not the Great Depression either. A lot of what is taking place today has some rhymes with various past episodes, but we are charting new territory with new lessons to be learned to add to the future policy maker playbook. We are likely in the very early stages of this latest banking crisis that could take months if not years to play out. SVB Financial, Signature Bank, Silvergate Bank, and Credit Suisse are already gone. Who’s next?

The song is over. Over the last fourteen years since the Great Financial Crisis (GFC), we were reassured that problems with the banks were behind us. In 2017, then Fed Chair Janet Yellen declared that we will not see another financial crisis in our lifetime. The next year, legislation was passed that eased regulations on all but the largest banking institutions. It was music to the ears of capital markets awash in liquidity, low volatility, and high-risk tolerance. But in the midst of a sustained bout of blistering hot inflation that induced the U.S. Federal Reserve to whipsaw from effectively promising to keep interest rates pinned at 0% until at least 2024 this time two years ago to launching into its most aggressive rate hiking campaign since the 1970s this time a year ago, the consequences of such abrupt and dramatic monetary policy swings are now coming into view. The song is over, and what we have seen so far is likely only the beginning of what is ahead now.

Getting in tune. Much has been written and pontificated about what has taken place in the banking system over the last two week since March 8 when Fed Chair Jay Powell flexed before Congress that the Fed was poised to raise interest rates by a half point at its March 22 FOMC meeting (what a difference a fortnight makes). It’s not that nothing more needs to be said on these topics, but it is also worthwhile to step back and reflect on selected perspectives that may be getting overlooked as the narrative rapidly unfolds.

March madness. I don’t know about you, but debating whether the global financial system might implode is not the best way to relax over weekend. Yet for the past two weekends, that’s exactly what we’ve had to game out. During the weekend of March 11-12, we held our breath wondering whether the U.S. financial trinity – the Treasury, the Federal Reserve, and the FDIC – would come up with an emergency solution to save the financial system from rampant bank runs before the markets in Asia opened on Sunday night. The next weekend of March 18-19, we waited and wondered whether the Swiss would be able to arrange a shotgun merger between its two banking behemoths and prevent the meltdown of a Systemically Important Financial Institution (SIFI). What new crisis threatening the global financial system will we have to look forward to in the coming weekends? Only time will tell.

Revising my teaching notes. So as I prepare my Intro to Finance lecture discussing how creditors are paid in the event of a liquidation, the events of the past weekend have provided a whole new twist to the discussion. For when it comes to the order in which people traditionally get paid in liquidation, it’s secured debt holders first, then senior unsecured lenders, followed by junior subordinated debt holders, then preferred stockholders, and both last and least (and typically nothing at all) common stock holders. Needless to say it was eyebrow raising when in the case of Credit Suisse the subordinated debt holders got wiped out yet the common stock holders received $1 billion $2 billion $3 billion in a merger with UBS that was completed without the customary shareholder approval vote.

Listen, I get it that there simply was not the time to get shareholders to vote on a deal that absolutely had to be done over a weekend, but not only exempting the rule of law but also having the deal structured in a way that leaves head scratching questions in terms of the way that it was structured is not the best for engendering investor confidence going forward. Something tells me that this may not be the last we hear AT1 debt and banking system instability uttered in the same sentence.

Tightening lending standards. If you are running a small or mid-sized regional bank, it has been a traumatic past two weeks. It has been particularly traumatic if you are among the small or mid-sized regional banks that exercised poor credit management by doing things like using your depositors money to load up on long-term Treasuries and MBS in 2021 just before they were set to lose as much as 30% of their value.

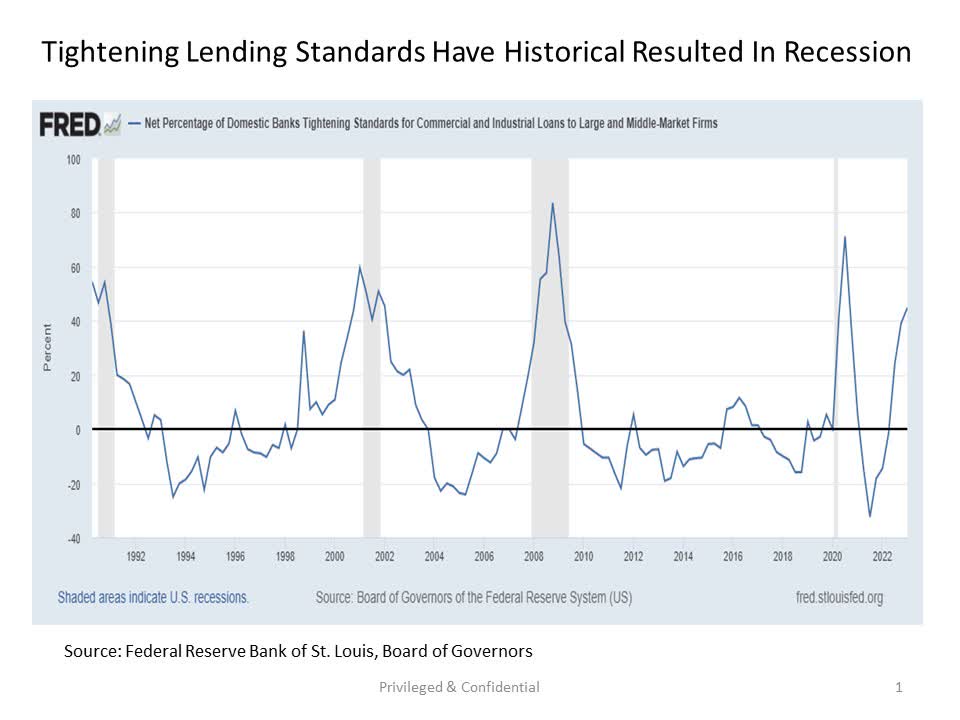

With this potential fight for survival in mind, you may be far less inclined today than you were two weeks ago as a small or mid-sized bank to lend money out to your institutional and retail customers. And if the regional banks that serve so many local communities across the country share this more cautious inclination, this means less home buying, less car buying, less consumer spending, less capital expenditures, and less hiring of new employees. Add all of these “less”es together, and you have an economic recession, just as we have seen several times in the recent past as evidenced in the chart below.

The deeply inverted yield curve has been screaming recession for quite a while now, and recent developments across the banking landscape have not only meaningfully improved the probability of recession, but also that any such recession is likely to be a bit deeper and longer than previously anticipated.

The fact that stocks continue to trade at a premium coupled with the fact that corporate earnings are still toward the high end of their historical range with considerable room to come back down suggests that the road ahead for stocks over the next few months could get a bit bumpy before it’s all said and done.

The banking crisis may do the Fed’s work. If one wants to try to put a silver lining on idiosyncratic bank failures and stressful weekends waiting for emergency policy rescues, a positive that is likely to come from the recent banking crises and the probable tightening of lending standards is that it is likely to bring down inflation both further and faster than we would have seen otherwise. As I often like to say to my Principles of Macro students, if you have too much money chasing too few goods, a great way to solve it is by simply taking money away from people. And since politicians on all sides of the political aisle no longer have the resolve to actually raise taxes on anyone other than the ultra-wealthy, raising interest rates and tightening lending standards are ways to do it. If people don’t have money, they can’t spend it, and inflation comes back down.

A sooner and deeper recession may actually help at risk banks. What has put so many small and mid-sized banks at risk has been the precipitous decline in long-term Treasury and MBS prices. But if inflation comes down and the economy falls into recession, both of these forces are typically meaningful tailwinds for these same securities as interest rates eventually come back down and investors take flight to safety. It’s an interesting thought pretzel to think that an economic recession could help fix the banking crisis while an ongoing economic expansion could send more banks over the edge.

Who’s next. Bringing this all back together, it is very likely that we are still in the very early stages of a banking crisis that may take many months to play out. It is important to remember that when the U.S. Federal Reserve raises interest rates, it historically takes upwards of twelve months before the tightening effects of the rate hike have fully worked their way through the economy. And given that the Fed only started hiking rates at this time last year, this means that only the first 25 bps rate hike from last year has fully come out the other side and we have 450 bps of interest rate hikes still making their way through the proverbial snake. This includes four consecutive 75 bps bombs from the middle to latter part of last year as well as the latest 25 bps cherry on top of the rate hiking cycle cake that the Fed delivered coming out of their latest FOMC meeting this Wednesday. Somehow, I have a sneaking suspicion we may someday look back with derision on this last rate hike. It will be interesting to see.

With all of this in mind, we should remain mindful that the stream of banks under stress may not be continuous as we continue through 2023. We may go through prolonged stretches where it looks like the problem is behind us (May 2008, anyone?) only to find a new set of problems emerge in a different segment of the financial sector. Thus, keeping a close eye on further rumbles across the financial sector is a prudent strategy as we move forward from here.

As for who’s next in the meantime, I am not breaking any news by saying that First Republic Bank (FRC) remains the institution to watch. The situation remains highly tenuous despite the repeated efforts of both public and private institutions to resuscitate the ailing bank. If First Republic ultimately succumbs, pressure on other at risk regional banking institutions is not only likely to persist but amplify. On the other hand, if First Republic perseveres, such a period of relief from immediate banking stress may follow.

Who’s last. If we go through a worst case scenario thought exercise, it’s reasonable to consider where the road might end in the current banking crisis. A name that is worth monitoring in this regard is Bank of America (BAC), which of course is one of the largest financial institutions in the world and among the top of the SIFI category. Of course, nothing at all is imminently at issue with Bank of America, but it does have a notably larger long-term bond portfolio relative to its major banking institution peers. As a result, it is worth monitoring as a back-end measure of underlying financial sector stress.

We won’t get fooled again. Oh no, we so will. A defining characteristic of financial markets and the policy makers that oversee them is a memory that seemingly lasts about 18 months to two years at most. Unfortunately, this leads markets and policy makers to unwittingly and repeatedly fall into the same traps, only through different means. Fortunately for investors, such dislocations lead to attractive opportunities for those that are prepared and positioned to capitalize. Thus, maintaining a sharp focus on potential downside risks such as ongoing banking industry volatility is a productive way to navigate short-term turbulence while seeking to capitalize on long-term upside.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. Great Valley Advisor Group and Stonebridge Wealth Management are separate entities.

This is not intended to be used as tax or legal advice. Please consult a tax or legal professional for specific information and advice. Third party posts found on this profile do not reflect the views of GVA and have not been reviewed by GVA as to accuracy or completeness.