Investors have no shortage of things to worry about in the current environment. The threat of a looming economic recession, banking crises, and the ongoing debt ceiling debate are just a few of the current threats. As a result, investors are understandably nervous about getting blindsided by a sudden and sharp downside move in the stock market. Fortunately, the market has a variety of indicators that we can monitor to determine whether a major stock market plunge is potentially lurking around the corner.

VIX. One indicator worth monitoring is the CBOE Volatility Index, or the VIX. Known as the “fear gauge”, it typically spikes when the stock market plunges. The VIX can also provide us with early warning signals about immediate-term stock market shifts. For example, a major stock market downdraft is typically preceded by the VIX pushing steadily higher.

Where are we today? The VIX has been drifting lower throughout much of 2023 so far and still remains toward the low end of its historical range even after the recent jump in the last couple of trading days.

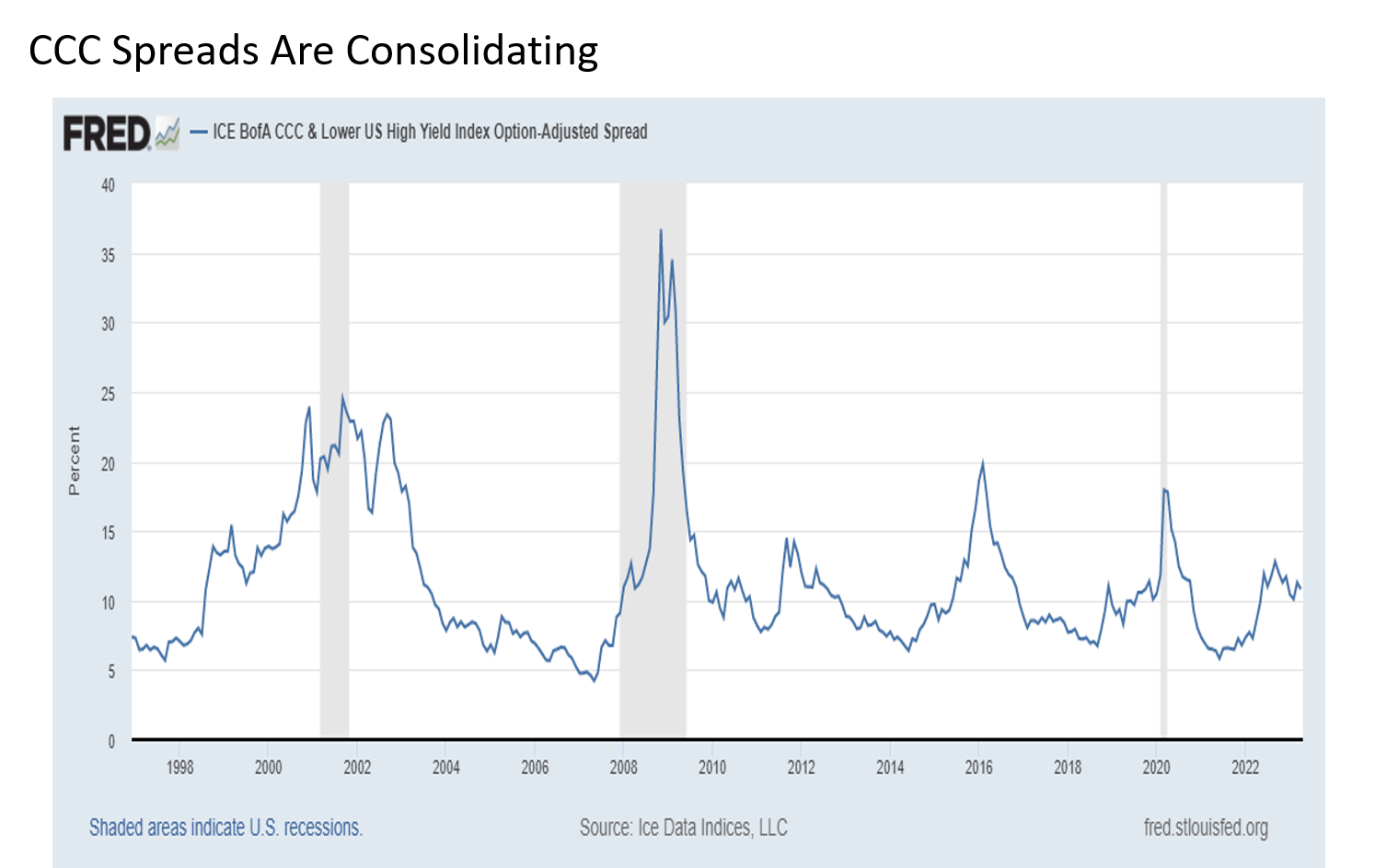

Spreads. Another indicator worth monitoring to predict a major stock market shock to the downside is CCC or lower spreads. This is the additional interest rate that investors need to receive to compensate for their risk of buying the lowest quality corporate bonds in the marketplace today.

Historically, this spread gets bigger ahead of a stock market correction, which makes sense since investors will avoid the riskiest investments first before they get to the point where they are ready to throw the entire stock market overboard.

Where are we today? While CCC spreads are higher than where they were at the start of 2022, they have been steadily falling for more than eight months after peaking last September.

Cryptocurrency: While cryptocurrencies remain a controversial topic in isolation, they are useful to monitor as a stock market speculation indicator. What’s the thinking here? Cryptocurrencies like Bitcoin are highly speculative investment instruments. So if the price of Bitcoin is rising, this means that the speculative appetite among investors generally is strong. Conversely, if Bitcoin is falling, it means that investors are likely pulling in the reins on speculation.

Where are we today? Bitcoin prices continue to hold most of the gains since bouncing off of the October lows and are far from trending lower at the present time.

No clear and present danger. While the news flow surrounding the economy and markets indeed remains generally negative and we may eventually see more sustained stock market weakness in the months ahead, the speculative mood of the markets at least for the moment appears to remain sufficiently strong to suggest that any sudden and sustained downside move in stocks is not likely imminent.

Tracking #: 441243-1

Disclosure: Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.