That was fast. It was just one week ago that this Chief Market Strategist was putting pen to paper to raise early warning signals about potential signs of economic slowing amid an environment where inflationary pressures were bubbling underneath the surface. While a handful of most recent data points certainly do not a trend make and only time will continue to tell, recent data on the U.S. economy suggest we may be doing just fine.

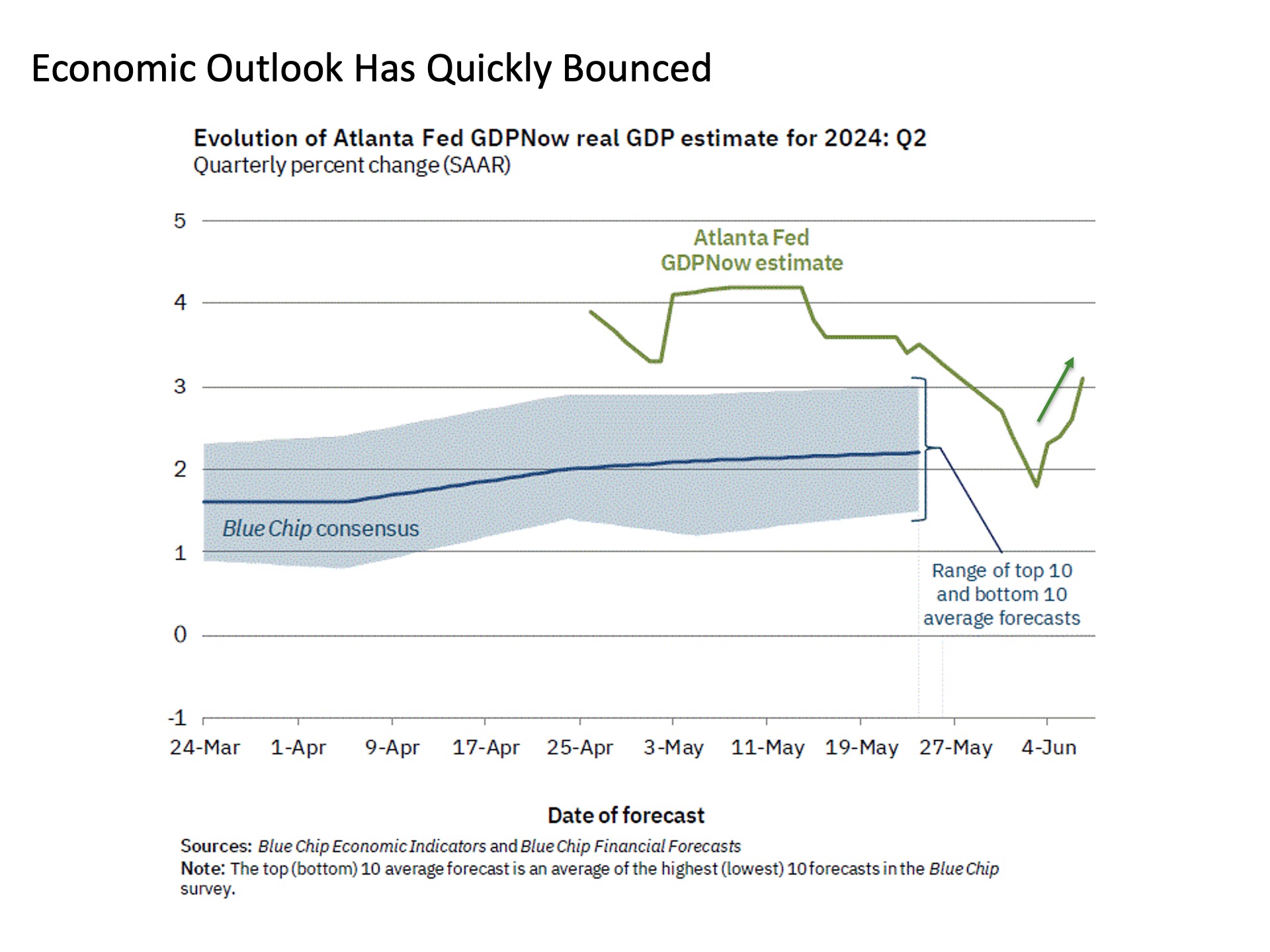

Revitalized growth outlook with qualifications. After cascading lower for a few weeks into the start of June, the forecast for economic growth according to the Atlanta Fed GDP Now has quickly bounced back to life. Since bottoming at 1.8% on June 3 at levels below the consensus of blue chip economists for the first time in recent memory, current projections have surged back above 3% thanks to strong employment and trade readings in recent days.

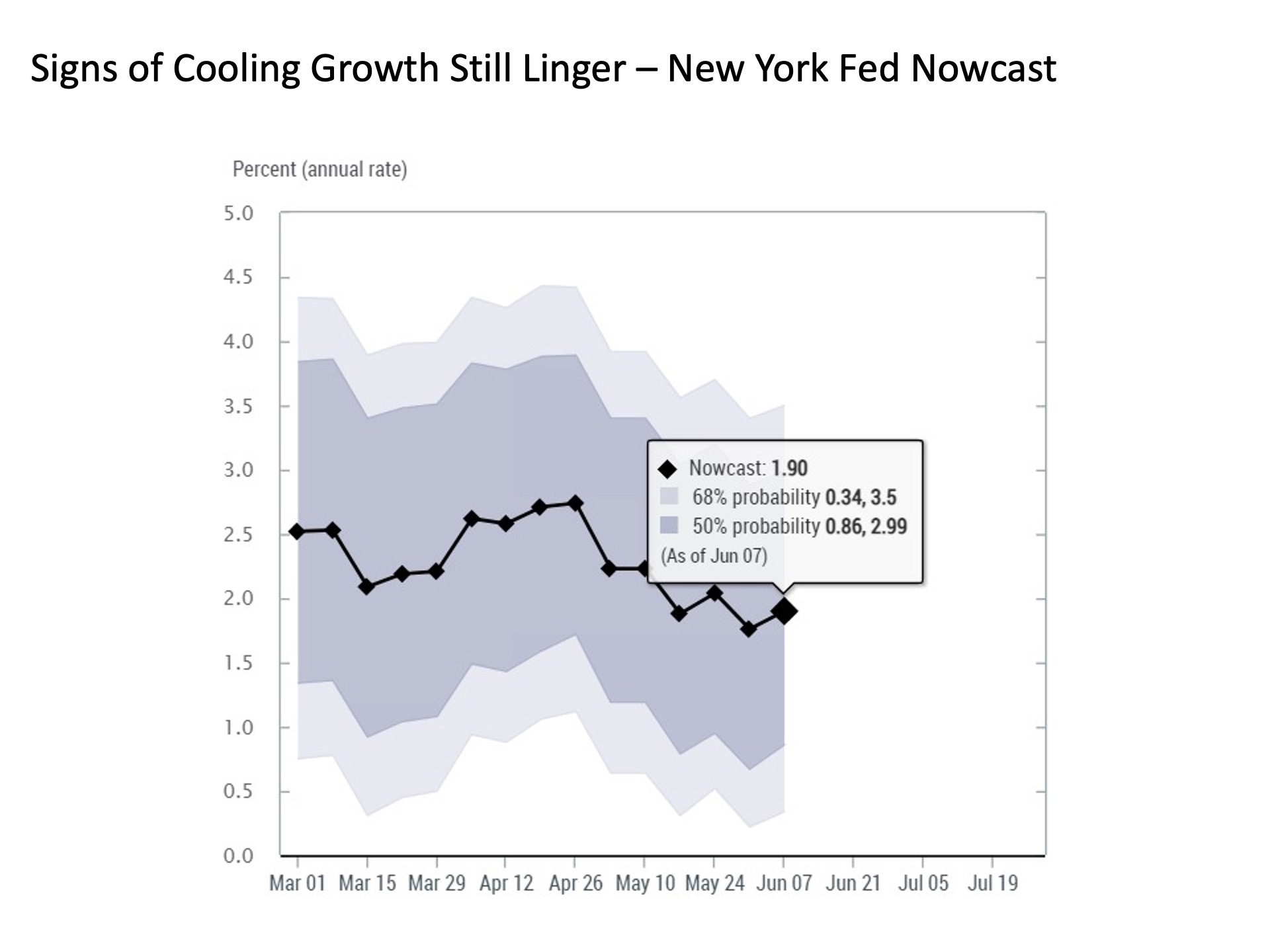

While this bodes well for ongoing fundamental support for rising U.S. stock prices, the recent bounce in the economic forecast does not mean we are out of the woods by any means in terms of a potential cooling of growth. For while the Atlanta Fed GDP Now forecast may have surged anew, the New York Fed Nowcast remains adrift below 2%.

So while the latest news on the economy is reassuring, we are still not out of the cage of potential economic weakening in the months ahead.

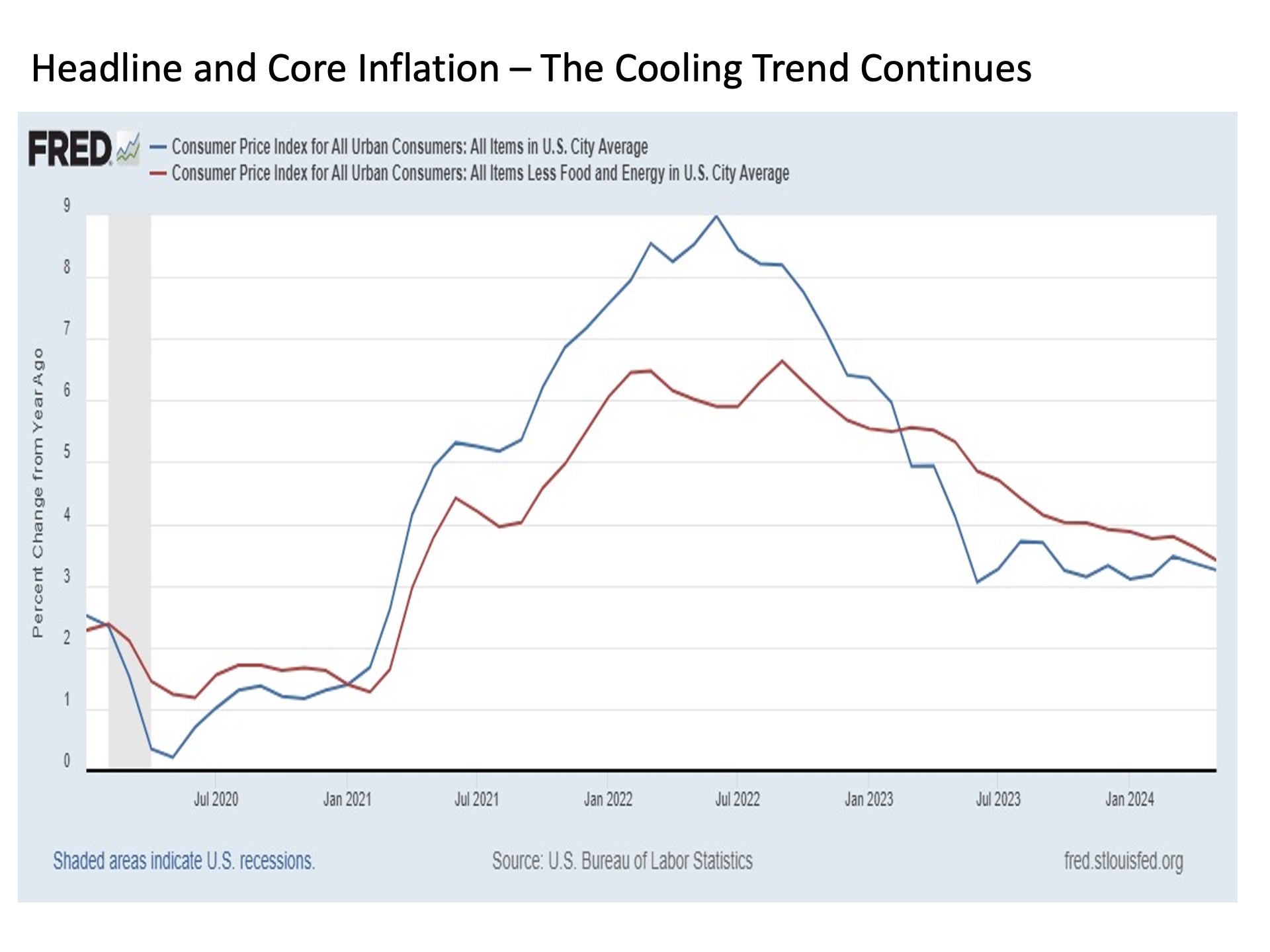

Positive signs on the inflation front. The latest news on the inflation front was also constructive. In a theme that has been reiterated dating back to last summer, a renewed rise in inflation continues to loom as arguably the primary downside risk for capital markets. With this in mind, the latest Consumer Price Index readings from the Bureau of Labor Statistics for the month of May that came out this week warranted close attention. And for those anticipating that the inflation gotta gotta be down, the latest report this Wednesday did not disappoint.

On the headline and core inflation front, the latest data looked particularly constructive. For the month of May, the annual headline inflation rate trimmed just over 10 basis points from 3.36% to 3.25%. As for the core inflation reading excluding the more volatile food and energy components, the steady downtrend continued as the annual rate hit a new post inflation cycle low of 3.41%, which was down more than 20 basis points from the previous month.

While these +3% readings are still well north of the sub-2% levels we all came to know so well during the post Great Financial Crisis period, they are readings that would have been considered right about on the mark from a price stability perspective in the pre Great Financial Crisis period. And more importantly, they continue to trend in the right direction, which continues to be lower.

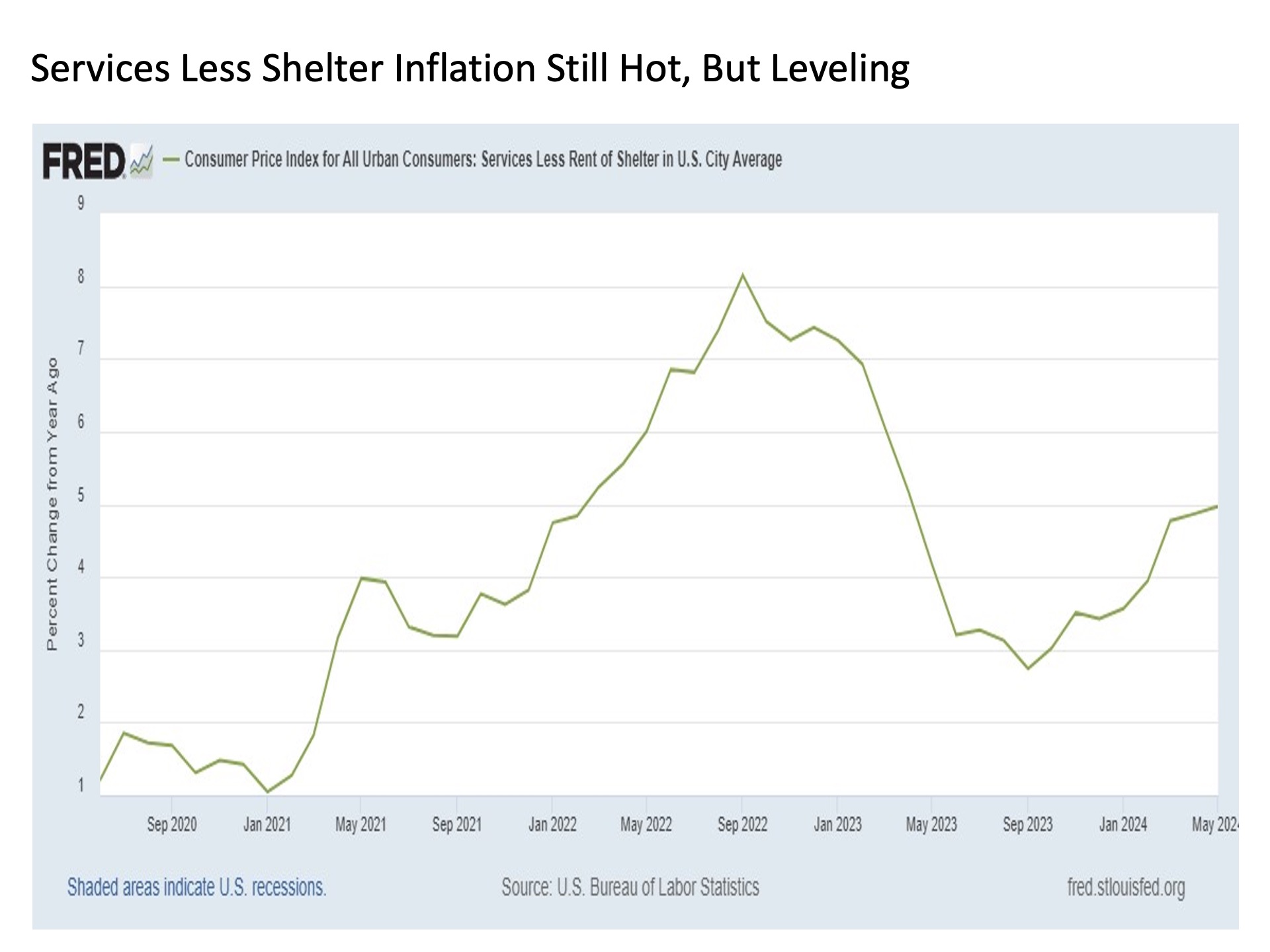

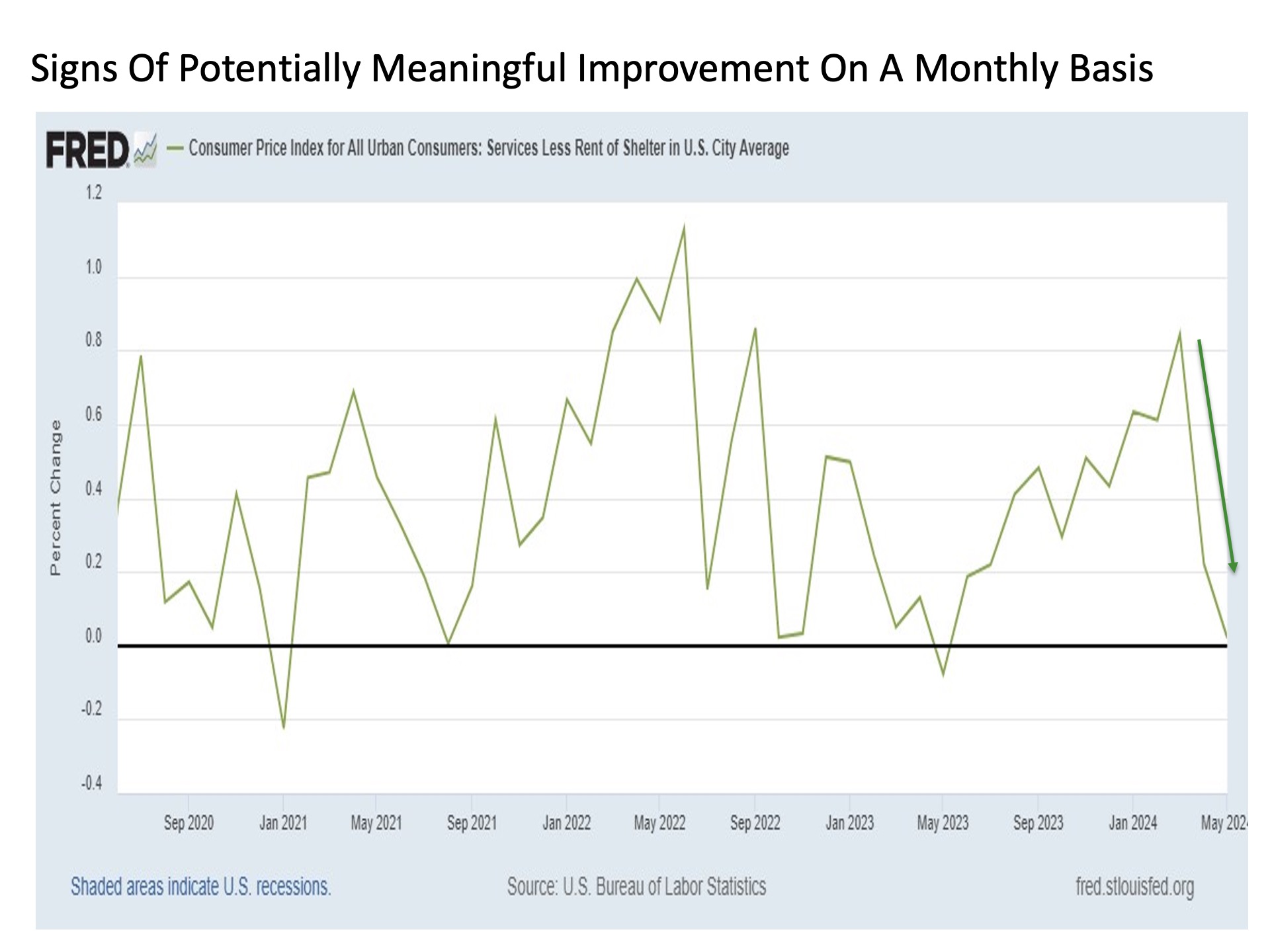

While trends in headline and core inflation are indeed promising, a notable area of concern beneath the surface was building services inflation pressures. For while headline and core inflation continue to trend lower, services ex shelter inflation has been steadily rising since last September toward 5% today.

Although the latest annual reading on services ex shelter inflation continued to rise, it came with some notable good news. First, the latest increase was only gradual, climbing another 10 basis points for the second month in a row, which continues to be a mere fraction of some of the spikes that we were seeing on this front earlier in the year.

Building on these more constructive recent developments, services ex shelter inflation on a month-over-month basis. For after steadily rising since May 2023 on a month-over-month basis to a peak as recently as March 2024, this reading as suddenly plummeted over the last two months to virtually flat in May. This is a positive development, as it preliminarily suggests that some of the pricing pressures lurking underneath the headline surface may be abating.

Bottom line. The latest batch of economic data has understandably put a lift underneath the economic forecasts and the market outlook. While these downside risks warrant continued close attention in the months ahead, signs of renewed economic vigor and steadily waning inflation results is a great combination to help push stock prices higher over time if it continues to hold over time.

I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 591507-1